The purchase of credit is a technical solution offered by banks to those held by contracted several loans (mortgage, car loan, revolving credit, credit work, ect .. .) and what have, at some point, for one reason or another, a great financial difficulty repaying several different monthly payments. It is therefore to consolidate all these loans into a single loan with one monthly payment and usually longer lasting compared to the previous credits.

Consider an example to better understand how a debt consolidation happens in practice:

Example redemption credit :

One person (Joe) high income level (say, a monthly income of 6000 Euro) has decided to fund several personal projects which I quote below, for each credit, part of the cash flow statement you can calculate it yourself by clicking

- Mortgage Lending for the purchase of a house at 250 to 000 Euro APR of 6.2% repayable over

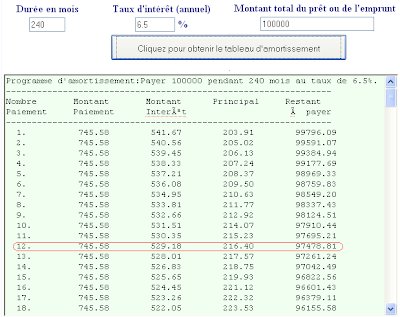

- credit works, the means to change and renew the house at 100 to 000 Euro APR of 6.5% with a repayment period of 20 years (240 months).

For simplification, Suppose that Joe makes these credits on the same date and at the end of his 12 th months back, for one reason or another, the income of Joe fell to 4000 Euro or more. We illustrate this new financial position at that date through the diagram below with:

- The amounts outlined in red represent the outstanding amount (payable)

- Amounts in black boxes represent the monthly payments (we assumed in this example that the monthly payments are fixed. (You can also see how calculate the monthly payments on a loan ) .

To cope with this kind of financial difficulty, the bank offers to buy these credits Joe, that is what still needs to pay (to pay) by providing a single credit in an amount refund all other amounts remaining credit payable (245,681.12 97,478.81 55,703.99) 398,863.92 Euro = with TEG 7% and a duration of 35 years. In such conditions, we have the cash flow statement following:

This new credit will have the effect of reducing the monthly carrying costs to 2548.18 Euro. But on the other hand, it extends the repayment period which means more interest charges than in the previous case. The purchase of credit significantly improves the remainder to live up to 1451.82 Euro as you can see

service credit purchase benefits a different category of borrowers who not necessarily a difficult

0 comments:

Post a Comment